Troostwijk’s online veilingen

Alles heeft waarde

Bieden is eenvoudig en kopen is veilig. Vertrouwd sinds 1930 met industrie-experts in heel Europa.

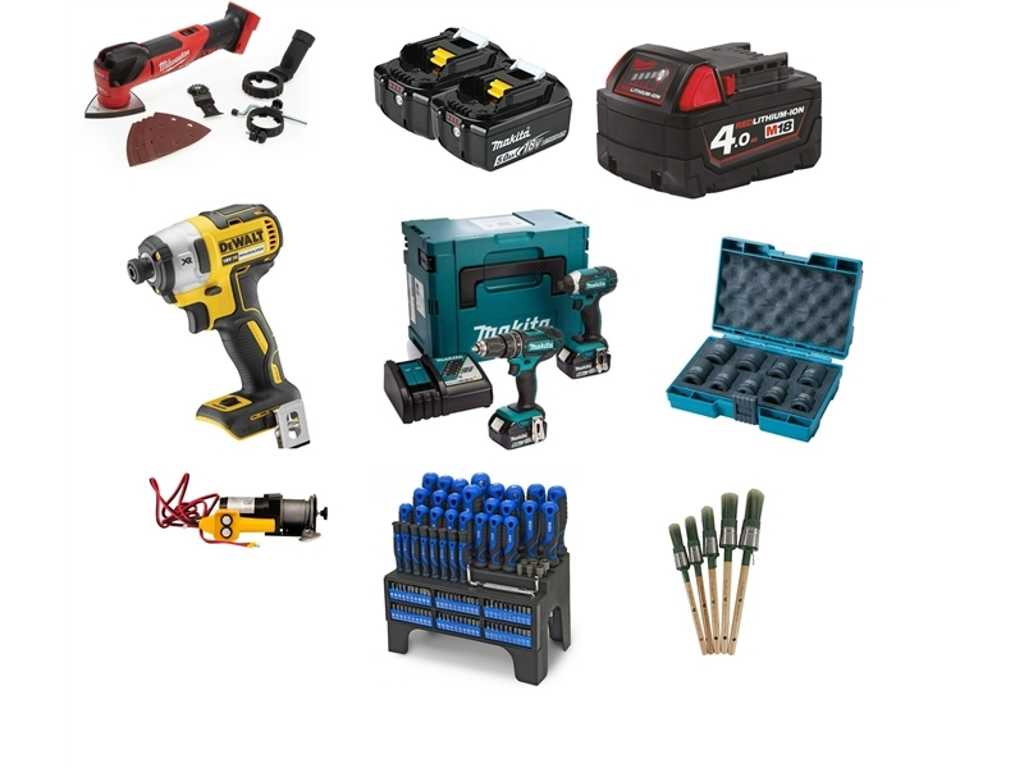

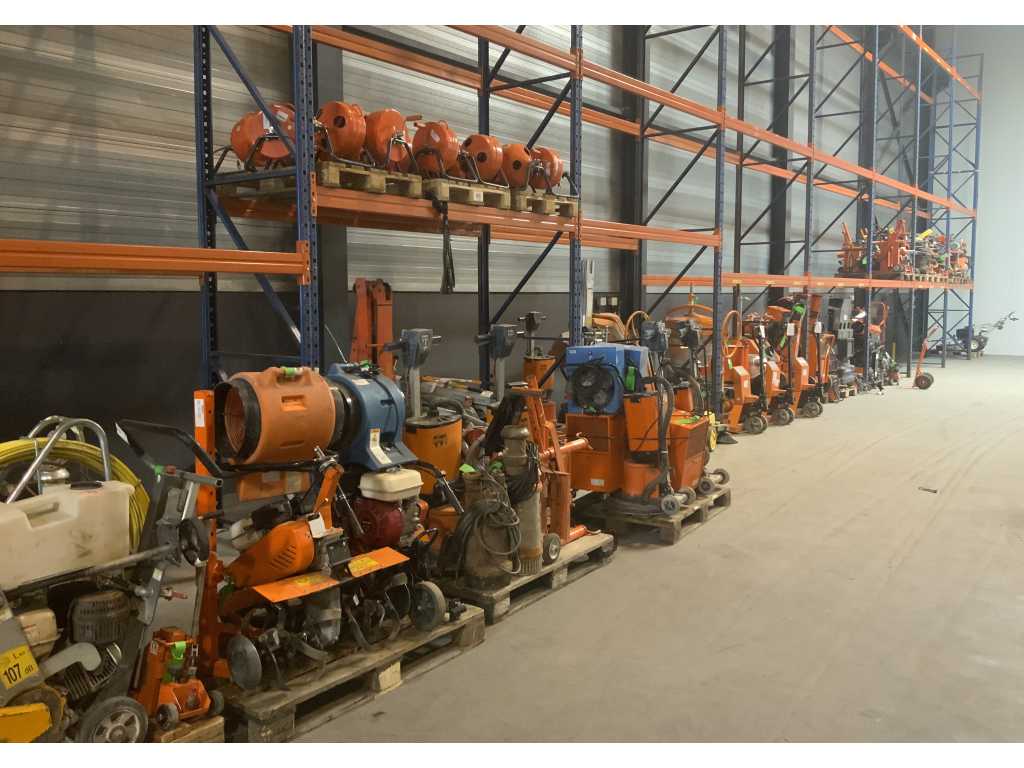

Aanbevolen kavels

Maak eenvoudig een account en bied mee!

Registreer;

Bekijk ons diverse aanbod in verschillende sectoren;

Volg en bied op uw kavels;

Houd uw biedingen, betalingen en facturen bij;

Ontvang als eerste een update over de nieuwste veilingen.

Veilen is het nieuwe verkopen!

Snel en eenvoudig uw machine verkopen voor de beste opbrengst? Dat is mogelijk en al vanaf 1 machine! Met behulp van ons internationaal netwerk vindt u de juiste koper en heeft u het bedrag binnen 2 weken. Kortom; door te veilen met Troostwijk bespaart u tijd en behaalt u het maximale resultaat.

Wat onze klanten zeggen

“Je krijgt goed advies en een maximaal resultaat"

"Natuurlijk is het dubbel om naar een lege loods te kijken, maar ik ben blij dat ik het heb gedaan. Mijn zoon bouwt verder aan een gezond bedrijf. De veiling bracht wat ik gehoopt had en ik had mijn geld al snel op mijn rekening. Maar belangrijker: het zijn vriendelijke mensen, die alles goed regelen. Dat geeft rust en keuzevrijheid".

"Troostwijk biedt mij een nieuw verkoopkanaal om mijn doelgroep te bereiken"

"Goederen verdienen een langer leven na de oorspronkelijke eigenaar. Wij renoveren IT-hardware zoals laptops, computers en schermen. Nadat we de hardware testen, indien nodig upgraden en alles controleren, is het goed dat ze naar de nieuwe trotse eigenaar gaan. Normaal gaat de verkoop alleen naar tussenpersonen, maar met behulp van Troostwijk ontdekte ik een nieuw internationaal verkoopkanaal om mijn doelgroep te bereiken. Online veilen is iets wat ik zeker meer zal gebruiken en andere ondernemers en bedrijven zeker aanraadt."